How to calculate VAT | Add or Exclude VAT on Certain Amount 💶

VAT Calculation: Add or Exclude VAT on a Certain Amount.

How to calculate VAT in simple wording. In this article, I use PHP to perform VAT calculations. How to calculate VAT in PHP. I also provide VAT_Trait.php below so, you can use that trait in any PHP project or frameworks like Laravel, Laminas, Zend or CakePHP, etc.

Using the above example you can calculate VAT on x-amount. Add VAT on x-amount or Exclude VAT on x-amount. And also calculate the added or excluded VAT value on the amount.

Requirements

you need VAT Percentage. current VAT percentage is 20% means In this article I’ll calculate VAT on X-Amount using 20% VAT.

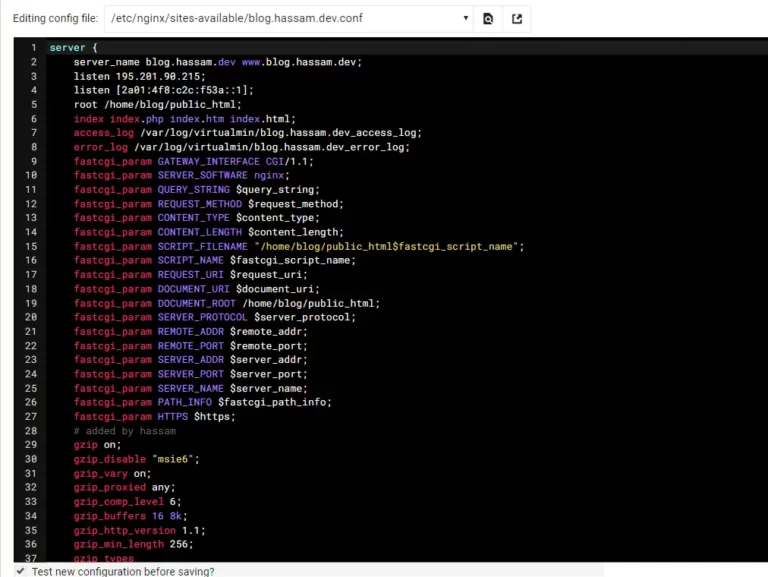

PHP 8.0, column decimal(12, 2)

Let’s Understand first

20% VAT add on 100 amount is = 120

20% VAT excluded on 100 amount is = 83.33

In-Depth

20% VAT add on 100 amount is = 120

| Amount | VAT, % | Operation | VAT added | Gross amount |

| 100 | 20 | add | 20.00 | 120.00 |

20% VAT excluded on 100 amount is = 83.33

| Amount | VAT, % | Operation | VAT excluded | Net amount |

| 100 | 20.00 | exclude | 16.67 | 83.33 |

Calculation

<?php

const VAT_PERCENTAGE = 20; // 20%

class Cart

{

public function calcAddVatToAmount($vat_percentage, $amount): float|int

{

// $amount * (1 + $vat_percentage / 100)

return round($amount * (1 + $vat_percentage / 100), 2); // simple roundof

//or simple

/*

* calculate 20% tax on x-amount

* ((20 % 100) * x-amount) + x-amount

* */

}

$cart = new Cart();

echo $cart->calcAddVatToAmount(VAT_PERCENTAGE, 9);

// Gross amount: 10.80

public function calcExcludeVatFromAmount($vat_percentage, $amount): float|int

{

// $amount - ($amount - $amount / (1 + $vat_percentage / 100)

return round($amount - ($amount - $amount / (1 + $vat_percentage / 100)), 2);

}

$cart = new Cart();

echo $cart->calcExcludeVatFromAmount(VAT_PERCENTAGE, 9);

// Net amount: 7.50

// if you want to check how much VAT is added on x-amount

public function calcVatAddedValue($vat_percentage, $amount): float

{

$amount_including_vat = $this->calcAddVatToAmount($vat_percentage, $amount);

// $amount_including_vat - $amount

return round($amount_including_vat - $amount, 2); // simple roundof

}

$cart = new Cart();

echo $cart->calcVatAddedValue(VAT_PERCENTAGE, 9);

// VAT added: 1.80

// How much VAT value is excluded then

public function calcVatExcludedValue($vat_percentage, $amount): float|int

{

// $amount - $amount / (1 + $vat_percentage / 100)

return round($amount - $amount / (1 + $vat_percentage / 100), 2);

}

$cart = new Cart();

echo $cart->calcVatExcludedValue(VAT_PERCENTAGE, 9);

// VAT excluded: 1.50

}

Step-by-step VAT functions

Let’s destructure Cart Class.

Calculate VAT Add on amount

<?php

const VAT_PERCENTAGE = 20; // 20%

class Cart

{

public function calcAddVatToAmount($vat_percentage, $amount): float|int

{

return round($amount * (1 + $vat_percentage / 100), 2);

}

}

$cart = new Cart();

echo $cart->calcAddVatToAmount(VAT_PERCENTAGE, 9);

// Gross amount: 10.80Calculate VAT Exclude on amount

<?php

const VAT_PERCENTAGE = 20; // 20%

class Cart

{

public function calcExcludeVatFromAmount($vat_percentage, $amount): float|int

{

return round($amount - ($amount - $amount / (1 + $vat_percentage / 100)), 2);

}

}

$cart = new Cart();

echo $cart->calcExcludeVatFromAmount(VAT_PERCENTAGE, 9);

// Net amount: 7.50Calculate how must VAT added to the amount

<?php

const VAT_PERCENTAGE = 20; // 20%

class Cart

{

public function calcAddVatToAmount($vat_percentage, $amount): float|int

{

return round($amount * (1 + $vat_percentage / 100), 2);

}

public function calcVatAddedValue($vat_percentage, $amount): float

{

$amount_including_vat = $this->calcAddVatToAmount($vat_percentage, $amount);

return round($amount_including_vat - $amount, 2);

}

}

$cart = new Cart();

echo $cart->calcVatAddedValue(VAT_PERCENTAGE, 9);

// VAT added: 1.80Calculate how must VAT excluded from the amount

<?php

const VAT_PERCENTAGE = 20; // 20%

class Cart

{

public function calcVatExcludedValue($vat_percentage, $amount): float|int

{

return round($amount - $amount / (1 + $vat_percentage / 100), 2);

}

}

$cart = new Cart();

echo $cart->calcVatExcludedValue(VAT_PERCENTAGE, 9);

// VAT excluded: 1.50VAT Trait for PHP projects e.g Laravel, Laminas, etc

You can use the below trait in any PHP project.

Download file Github Gist

Embedded File

Raw File

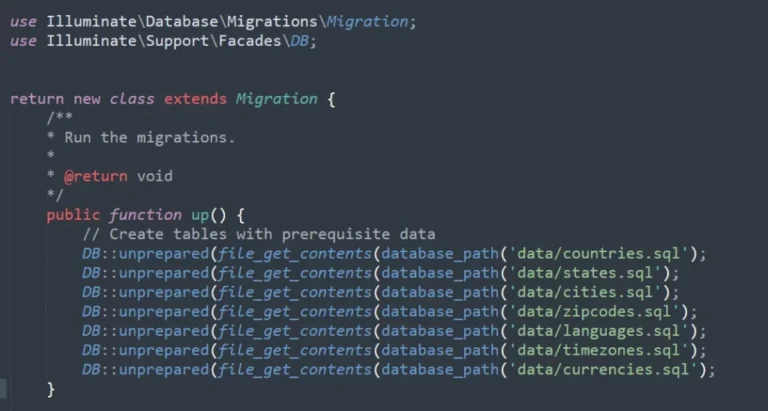

<?php

namespace App\Helpers;

class VAT_Helper

{

const VAT_PERCENTAGE = 20;

}

// -------------------------------------

?>

<?php

namespace App\Traits;

use App\Helpers\VAT_Helper;

trait VAT_Trait

{

public function calcAddVatToAmount(float $amount, int $vat_percentage = VAT_Helper::VAT_PERCENTAGE): float|int

{

return round($amount * (1 + $vat_percentage / 100), 2);

// e.g Gross amount: 10.80

}

public function calcVatAddedValue(float $amount, int $vat_percentage = VAT_Helper::VAT_PERCENTAGE): float

{

$amount_including_vat = $this->calcAddVatToAmount($amount, $vat_percentage);

return round($amount_including_vat - $amount, 2);

// e.g VAT added: 1.80

}

public function calcExcludeVatFromAmount(float $amount, int $vat_percentage = VAT_Helper::VAT_PERCENTAGE): float|int

{

return round($amount - $amount / (1 + $vat_percentage / 100), 2);

// e.g Net amount: 7.50

}

public function calcVatExcludedValue(float $amount, int $vat_percentage = VAT_Helper::VAT_PERCENTAGE): float|int

{

return round($amount - $amount / (1 + $vat_percentage / 100), 2);

// e.g VAT excluded: 1.50

}

}

// ---------------------------------------------------

?>

<!-- How to use -->

<?php

namespace App\Http\Services;

use App\Helpers\VAT_Helper;

class CartService

{

use VAT_Trait;

const VAT_PERCENTAGE = 20; // you can skip this because default VAT percentage added i VAT_Trait.

public function createCartItem(Request $request)

{

$product_price = $request->input('product_price'); // e.g 9$

$cartItem = CartItem::create([

'product_id' => $request->input('product_id'),

'sku' => $request->input('sku'),

'total_weight' => $request->input('weight') * $request->input('quantity'),

// single amount

'price' => (float) $this->calcAddVatToAmount($product_price, VAT_Helper::VAT_PERCENTAGE), // 2nd parameter is optional

// single amount * quantity

'total' => (float) $this->calcAddVatToAmount($product_price * 5, VAT_Helper::VAT_PERCENTAGE),

// check how much VAT added on single amount

'tax_amount' => (float) $this->calcVatAddedValue($product_price, VAT_Helper::VAT_PERCENTAGE),

// check how much VAT added on (single amount * quantity)

'total_tax_amount' => (float) $this->calcVatAddedValue($product_price * 5, VAT_Helper::VAT_PERCENTAGE),

]);

}

}

?>

Summary

Using the above example you can calculate VAT on x-amount. Add VAT on x-amount or Exclude VAT on x-amount. And also calculate the added or excluded VAT value on the amount.